How Hard Money Atlanta can Save You Time, Stress, and Money.

Wiki Article

The 9-Second Trick For Hard Money Atlanta

Table of ContentsThe Ultimate Guide To Hard Money AtlantaNot known Incorrect Statements About Hard Money Atlanta The Definitive Guide to Hard Money AtlantaNot known Details About Hard Money Atlanta

One such variable is your service' operating costs using the complying with debt-to-equity ratio. Debt-to-Equity Proportion= Total Investors' Equity/Total Obligations This debt-to-equity ratio examines the quantity of shareholders' equity and overall liabilities in the kind of finances your company makes use of. How will mezzanine funding influence this ratio? Companies that have a lot more equity than liabilities may desire to balance out this proportion.Some structure examples of mezzanine funding are liked supply or unsubordinated debt. A company could go after the unsubordinated financial obligation framework of mezzanine funding and also advantage in the lasting with a well balanced leverage ratio. Understandably, achieving a much better take advantage of ratio might not be the initial reason you go after mezzanine financing.

When it pertains to mezzanine funding in property, loan providers have a tendency to take a much more hands-off technique. That implies that investors typically still preserve full control of their building. They'll have the last say in what is occurring with their building while still receiving the funding they need to move on with jobs.

Sometimes, you might be able to repay your loan at the end of the term as opposed to during. If this is the instance, you'll have more time to concentrate on your investment and expanding your projects so you can quickly afford the payment at the end of the term.

Our Hard Money Atlanta Statements

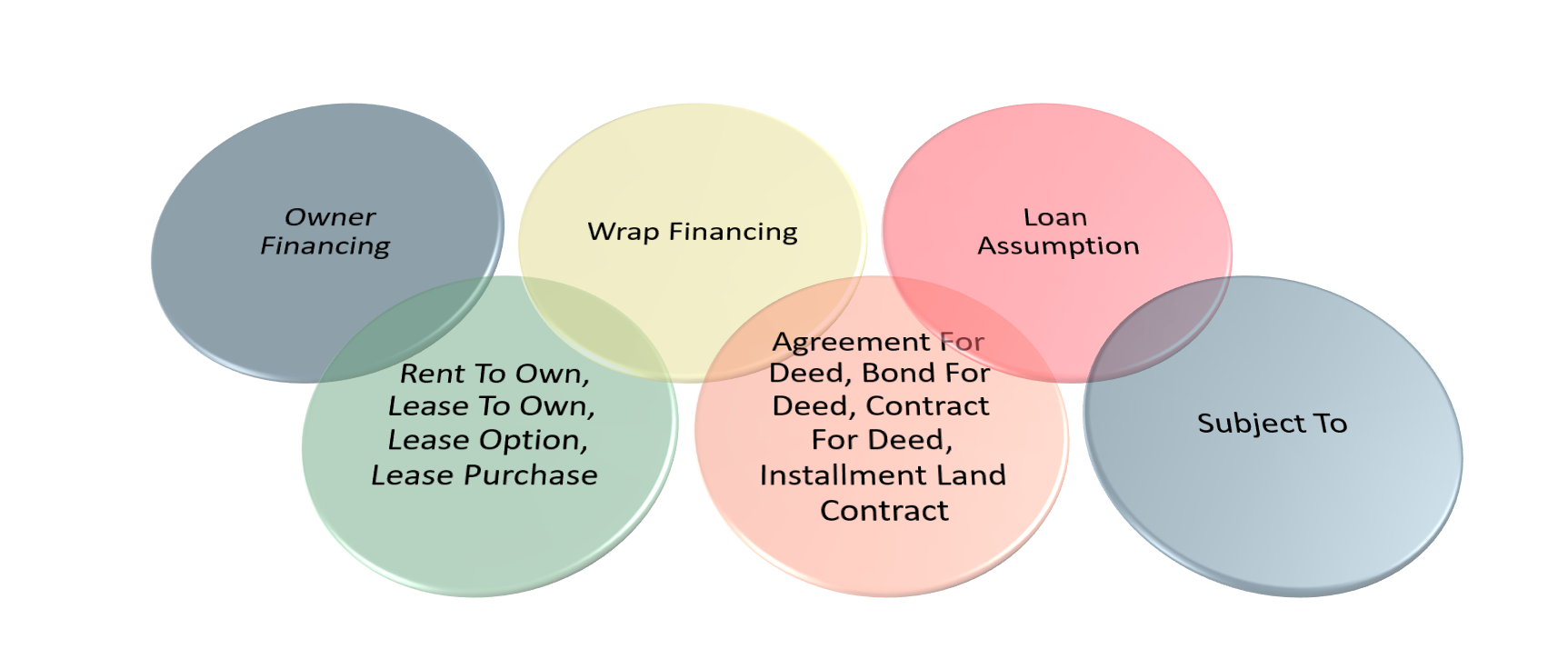

Getting a residential property "subject-to" indicates a purchaser essentially takes control of the vendor's continuing to be home mortgage equilibrium without making it official with the lending institution. It's a popular strategy amongst investor. When passion rates climb, it may likewise be an eye-catching financing alternative for general property buyers. Find out more concerning buying subject-to, exactly how it functions, and the benefits and drawbacks of this method.Getting a subject-to residence is attractive to purchasers if they can obtain a reduced passion rate by taking over payments. This plan presents threats for the customer if the lending institution requires a full finance payback or if the vendor goes into bankruptcy. Purchasing subject-to means purchasing a house subject-to the existing home mortgage.

Rather, the customer is taking control of the settlements. The overdue equilibrium of the existing home mortgage is after that computed as component of the purchaser's acquisition cost. Expect the seller took out a mortgage for $200,000. They had paid $150,000 of it prior to they determined to market the house. The new purchasers would after that pay on the continuing to be $50,000.

The smart Trick of Hard Money Atlanta That Nobody is Talking About

For the genuine estate investor who intends to lease or re-sell the residential or commercial property down the line, that means even more area commercial. For many buyers, the primary factor for getting subject-to homes is to take over the vendor's existing rate of interest. If existing rate of interest go to 4% as well as a seller has a 2% set rate of interest price, that 2% variation can make a substantial difference in the customer's regular monthly payment. hard money atlanta.

Typically, there are 3 types of subject-to options. The most usual kind of subject-to happens when a purchaser pays in cash the difference in between the get redirected here purchase price and also the vendor's existing finance balance.

Expect the residence's sales cost is $200,000, with an existing car loan equilibrium of $150,000. The seller would certainly bring the continuing to be balance of $30,000 at a different rate of interest price and terms bargained between the events.

Some Known Facts About Hard Money Atlanta.

A wrap-around subject-to offers the seller an override of rate of interest, due to the fact that the seller earns money on the existing home loan equilibrium. A wrap-around is another funding which contains the first, as well as it can be seller-financed. Making use of the instance over, suppose the existing home loan brings a rates of interest of 2%. If the list prices is $200,000, and the buyer takes down $20,000, the seller's carryback would certainly be $180,000.

Not every financial institution will call a finance due as well as payable upon transfer. In certain situations, some financial institutions are merely satisfied that somebodyanybodyis making the payments. However banks can exercise their right to call a car loan, as a result of the acceleration condition in the home mortgage or depend on act, which is a risk for the buyer.

Lending assumption, on the various other hand, is different from a subject-to you could try here deal. If a buyer makes a finance presumption, the buyer officially assumes the car loan with the bank's approval. This method implies that the seller's name is gotten rid of from the car loan, and the buyer qualifies for the car loan, simply like any various other kind of financing.

Report this wiki page